FINTECH CYBERSECURITY: WHY FINTECH NEEDS IT THE MOST?

The FinTech industry combines financial services with technology to deliver faster, more accessible solutions, ranging from digital banking and mobile payments to blockchain platforms, but with this rapid digitization comes heightened risk. Rapid innovation in financial technology has exposed new threats, making fintech security concerns a top boardroom priority.

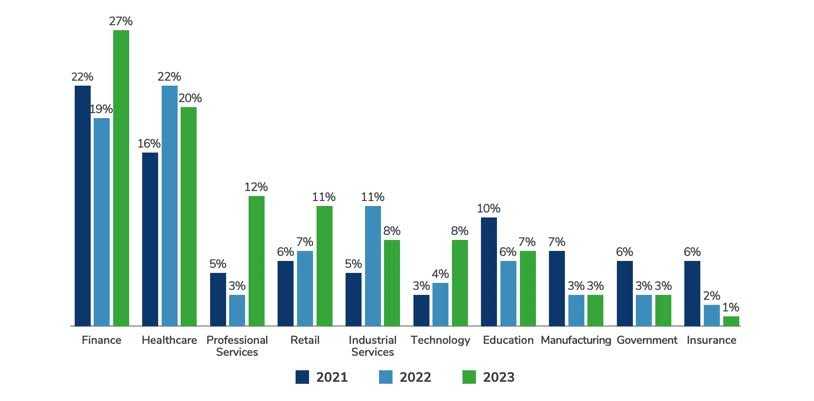

The chart displays the distribution of data breaches from 2021 to 2023 across different industries (Kroll, 2023)

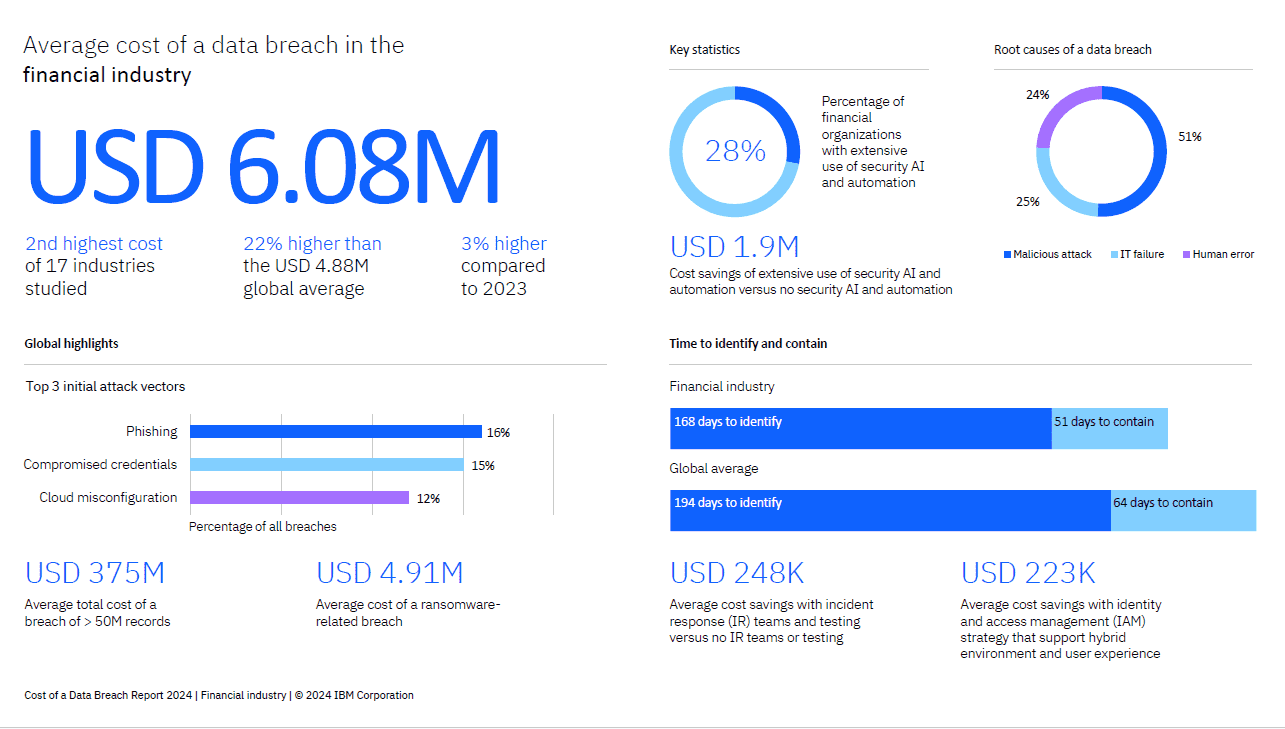

In 2024, the average data breach cost soared to a staggering $4.88 million, up from 4.45 million in 2023, the highest ever recorded in IBM’s annual report history. FinTech’s reliance on APIs, mobile apps, and cloud infrastructure makes it a prime target for cyber threats. As trust becomes the true currency of digital finance, fintech cybersecurity is no longer just a compliance need; it’s foundational to the sector’s credibility, resilience, and growth.

Why FinTech Is A Prime Cyber Attack Target?

The intersection of fintech cybersecurity and finance is now a battleground; every API, mobile app and transaction is a potential entry point, such as Social Security numbers (SSNs), bank account credentials, and sensitive payment information. The industry’s fast-paced innovation, driven by mobile-first experiences, APIs, and cloud-native infrastructure, often leads to expanded attack surfaces. Compounding the risk, many Fintech small businesses scale operations rapidly without investing in adequate security frameworks from the start.

Regulatory bodies like the SEC, CFPB, and FINRA impose strict compliance requirements, so the financial and reputational costs of a breach are significantly higher. Fintech and cybersecurity go hand in hand, as financial platforms remain prime targets for sophisticated cyberattacks.

Common Cybersecurity Threats to the FinTech Industry

With rising Fintech Industry challenges, the finance and cybersecurity relationship must evolve from reactive to proactive. FinTech companies face unique cybersecurity threats due to their digital operations and expansive technology stacks:

- API Attacks: APIs power innovation but also create vulnerable entry points for attackers to exploit data and breach services.

- Credential Stuffing: Reused passwords and weak authentication allow cybercriminals to automate access to user accounts.

- Synthetic Identity Fraud: Fraudsters combine real and fake information to create identities that evade detection in digital onboarding processes.

- Ransomware: Payment processors and neobanks are high-value targets, with attacks aiming to lock systems and extort critical financial data.

- Insider Threats: Hybrid work models increase the risk of unauthorized access, accidental data exposure, or malicious internal actions.

- Blockchain Security Threats: Blockchain security threats in fintech include smart contract vulnerabilities and cross-chain exploits, leading to over $1.8 billion lost in DeFi hacks in 2023 alone.

The importance of cybersecurity in financial services lies in safeguarding real-time transactions, sensitive data, and critical infrastructure. From APIs to third-party integrations, cybersecurity in FinTech safeguards the entire ecosystem. Ignoring fintech risks can lead to costly breaches, regulatory fines, and reputational damage.

Case Studies and Breaches

With sensitive data and digital infrastructure at stake, cybersecurity breaches in financial services cost companies millions per incident. Here are three high-impact fintech cybersecurity case studies where breaches shook the industry and reinforced the need for robust protections:

Rising costs of data breaches in the financial industry infographic

Robinhood Data Breach

In November 2021, Robinhood disclosed a breach affecting about 7 million user accounts after threat actors manipulated an employee via a social engineering attack. While Social Security numbers weren’t exposed, names and email addresses were opening doors to phishing and identity theft schemes. The incident undermined user trust and invited SEC scrutiny, culminating in a $45 million settlement. This breach demonstrates how targeted attacks on FinTech platforms can compromise sensitive data at scale, even without direct financial theft.

Block’s Cash App Security Incident

Block’s Cash App saw multiple data security failures. A major incident in December 2021 exposed personal and brokerage data of approximately 8.2 million users due to a former employee’s unauthorized access. The breach led to class-action litigation and a delayed customer notification timeline, increasing consumer risk. This incident highlights that insider threats, delayed remediation, and compliance failures can quickly escalate into reputation and trust-damaging crises.

Lending-Platform Phishing Scams

Phishing remains a pervasive threat within FinTech. Reports show that over 88% of breaches involve human error. Lending platforms have been repeatedly targeted by credential harvesting and social-engineering attacks, leading to unauthorized fund disbursements and breached customer accounts.

Public-facing applications are a growing attack surface in the FinTech world. 26% of phishing attacks now exploit these apps, taking advantage of their exposure to the internet. This highlights the urgent need for secure coding practices, continuous monitoring, and robust email security protocols to protect customer-facing digital assets.

Regulatory Compliance Is Only the Starting Point

Frameworks like SOC 2, PCI DSS, and ISO 27001 are essential for establishing trust with stakeholders and accessing new markets, but they are baseline expectations, not comprehensive security strategies. In the FinTech world, where the velocity of innovation often outpaces regulation, compliance does not equal security readiness.

Achieving certification proves that certain controls are in place at a moment in time. However, evolving threats, ranging from zero-day exploits to API abuse, demand continuous adaptation and proactive defense. Cybercriminals aren’t bound by audit cycles, and neither should security posture be.

That’s why real-time threat intelligence is no longer a luxury; it’s a necessity. FinTechs must operate with dynamic visibility across endpoints, cloud services, and third-party APIs. The goal isn’t just to pass audits, it’s to identify and mitigate threats before they escalate.

Solutions to Cybersecurity Threats in the FinTech Industry

To secure trust and stay ahead of evolving threats, FinTech organizations must adopt a layered, adaptive defense strategy. Cybersecurity fintech security solutions must go beyond compliance. Key solutions include:

- Zero-Trust Architecture: Assumes breach and verifies every request, internal or external, minimizing lateral movement.

- Multi-Factor Authentication (MFA): Reduces account takeover risk by adding identity verification layers beyond passwords.

- Cloud Security Posture Management (CSPM): Continuously assesses and remediates misconfigurations in cloud environments.

- AI-Driven Threat Detection: Accelerates identification of exceptions and reduces response time with intelligent automation.

- Third-Party Risk Management: Vetting vendors and conducting regular security audits to prevent supply chain vulnerabilities.

- Incident Response Playbooks: Predefined, tested plans ensure faster recovery and reduced breach impact.

- Security Awareness Training: Empower teams to recognize and prevent social engineering and phishing attempts.

Investing in automation, zero-trust frameworks, and real-time monitoring is key to improving cybersecurity efficiency in high-risk financial environments. Strong cybersecurity in finance builds customer trust, ensures regulatory alignment, and safeguards innovation. Without strong fintech data security, companies risk regulatory penalties, reputational damage, and customer trust loss.

Mobile App Security in Fintech

Mobile applications serve as a primary touchpoint between fintech and users, but they’re also a prime target for cyberattacks. Mobile app security must be treated as a core pillar of any robust fintech cybersecurity strategy.

Implementing secure coding practices, runtime protection, and in-app threat detection is essential to defend against risks like API abuse, reverse engineering, data leakage, and credential theft. These mobile-specific vulnerabilities require specialized safeguards that go beyond traditional compliance checkboxes. Integrating mobile app security into broader frameworks such as Zero-Trust Architecture, Multi-Factor Authentication (MFA), and AI-driven threat detection enhances resilience across the entire digital ecosystem.

How CISOs & Vendors Must Partner Proactively

In FinTech, vendor due diligence isn’t optional; it’s mission-critical. CISOs need assurance that third-party tools align with their security frameworks, risk appetite, and regulatory obligations. But that alignment starts with clear, strategic communication between executives and cyber vendors.

When cybersecurity vendors understand a CISO’s priorities from zero-trust architecture to breach response timelines, they can offer tailored solutions that deliver real outcomes, not just features.

Bottom-line

CISOs of financial institutions and cybersecurity vendors need to collaborate to implement the best intech cybersecurity solutions and practices to prevent monetary and reputation losses. The future of secure financial innovation depends on strong partnerships between cybersecurity and fintech leaders.

Execweb empowers cybersecurity vendors by providing direct access to CISOs within the fintech industry who are actively seeking targeted, high-impact solutions. Through organized one-on-one meetings and strategic matchmaking, Execweb helps vendors present their offerings in the context of real-world challenges and regulatory needs.

If you need more details, contact us at contact@execweb.com.

- 32 views

- 0 comments

Comment