Cybersecurity in Banking: Threats and Challenges

Let’s be real, cybersecurity in banking isn’t just a “tech” issue anymore. It’s a frontline business concern. Every click, transfer, or login could expose your data, your customers, or your entire institution to sophisticated cyber attacks. As financial services become increasingly digital, the risks are only growing.

Whether you're a major bank, a fintech startup, or a credit union, cybersecurity for financial services is no longer optional, but it's fundamental.

Why Cybersecurity in Banking Is More Important Than Ever

Banks already have rock-solid security. And they do try. But the threat landscape changes faster than most institutions can adapt. The rise of mobile banking, real-time transactions, open banking APIs, and cloud-based services has expanded the attack surface drastically.

Cybersecurity in financial services is now about more than just firewalls. It's about protecting the trust of millions, preventing financial loss, and staying compliant with regulations.

And let's not forget the stakes when there's a bank cyber attack, it’s not just money at risk. It’s your brand, your customer loyalty, and often, your entire infrastructure.

Common Cybersecurity Threats to the Financial Sector

So, what are the biggest cybersecurity threats to the financial sector today? Here’s what every finance professional needs to know:

1. Phishing and Social Engineering

Despite years of awareness campaigns, phishing is still the most common way hackers breach systems. These attacks have evolved from shady emails to well-crafted messages that mimic legitimate banking communications. For banks, training employees and customers alike is key to reducing risk.

2. Malware and Banking Trojans

Malware has grown more stealthy. Trojans like Emotet or Dridex can log keystrokes, hijack browsers, and drain accounts before anyone notices. This makes robust endpoint detection crucial for any cybersecurity solutions for banks.

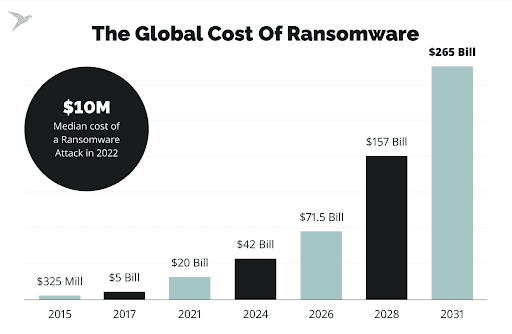

3. Ransomware

Imagine your entire banking system locked, with hackers demanding millions. That’s the nightmare of ransomware, and it’s increasingly common across cybersecurity in finance. Regular backups and response plans are your best bet here.

According to Tech Magic's projections, ransomware attacks will inflict $265 billion in damages by 2031.

Read our article on the major ransomware attack targeting the healthcare sector, involving Change Healthcare, and how Health-ISAC responded to this critical breach.

4. Insider Threats

Not every threat is external. Employees, knowingly or accidentally, can leak data or open security holes. A solid cybersecurity plan for financial institutions must include background checks, access controls, and internal monitoring.

5. API Vulnerabilities

Open banking has made data sharing easier, but it’s also exposed banks to new risks. Insecure APIs can be a backdoor for attackers. Secure coding practices and penetration testing are essential.

6. Distributed Denial-of-Service (DDoS) Attacks

These attacks flood banking websites or services until they crash. For customers, it means locked-out accounts; for banks, it’s lost trust and service disruption.

How Cybersecurity in Banking Sector Impacts Everyone

Cybersecurity in banking sector isn't just a boardroom concern, it's a public issue. Customers entrust their most sensitive financial data to banks, and breaches affect everyday people. The financial services industry is in the list of top 5 industries that need cybersecurity the most due to the sensitive nature of the data involved.

The rise in mobile and online banking has opened up new attack surfaces. With more customers accessing their accounts via smartphones and desktops, banks are expected to provide not only convenience but also airtight security. Cybersecurity for finance ensures smooth and safe operations for everyone involved, from customers and employees to shareholders.

Top Challenges in Bank Cybersecurity Today

We’ve covered the threats, but let’s talk about the challenges financial institutions face in building strong cybersecurity for banks:

- Legacy Infrastructure: Many banks still run on outdated systems that weren’t built for today’s digital demands.

- Compliance Pressures: Regulations like GDPR, PCI-DSS, and regional data privacy laws vary, and keeping up is tough.

- Shortage of Skilled Talent: Finding cybersecurity experts who understand bank data security is a growing struggle. To address skills shortages and compliance issues, many institutions are turning to managed cybersecurity services.

- Rapid Digital Transformation: As banks push for mobile-first solutions, they sometimes release features before they’re fully secured.

Must-Have Cyber Security Solutions for Banks

To stay ahead, banks and financial services need a multi-layered defense. Here are the key components of a strong cybersecurity in banking sector:

1. Zero-Trust Security Architecture

Never assume any access request is safe; verify everything. This model minimizes internal and external threats.

2. Multi-Factor Authentication (MFA)

Adding another layer (like biometrics or OTPs) to logins can block 90% of unauthorized access attempts.

3. Real-Time Threat Detection

AI and machine learning can analyze vast amounts of transactional data to spot fraud instantly, which is a major evolution in cybersecurity for finance.

4. Employee Training Programs

Tech won’t help if humans fall for phishing emails. Simulated attacks and ongoing education are a must for employees.

5. Cloud Security Best Practices

As more institutions migrate to the cloud, secure configurations and access controls are essential. Especially important for cyber security in financial services that rely on a hybrid infrastructure.

6. Endpoint Protection

Every device, whether a teller’s terminal or a customer’s phone, is a potential entry point. Secure them all.

7. Strong Vendor Risk Management

Third-party software providers can be the weak link. Vet every partner and monitor their security posture.

How Cybersecurity in Financial Services Is Evolving

Let’s face it: cybersecurity and banking are no longer reactive. It’s proactive, predictive, and evolving in real-time. Here’s what’s shaping the future:

- AI vs. AI: As attackers use AI to create smarter malware, defenders are using it to detect anomalies and threats before they spread.

- Quantum Computing: Quantum computers could break today’s encryption. Banks are already investing in quantum-safe security.

- Biometric Authentication: Fingerprints, face scans, and voice recognition are making authentication seamless and safer.

- Behavioral Analytics: Tracking how users normally behave helps flag unusual activity, boosting cybersecurity in financial services without annoying users.

Best Practices in Cybersecurity for Financial Institutions

Here are actionable strategies to strengthen cybersecurity in banking:

- Employee Training: Educate staff about phishing, safe browsing, and secure handling of data.

- Penetration Testing: Regularly test systems for vulnerabilities.

- Cloud Security: Use secure, compliant cloud platforms with strict access control.

- Data Backups: Regular, encrypted backups can help recover quickly after an attack.

- Continuous Monitoring: Real-time systems to detect threats before they escalate.

- Vendor Risk Management: Ensure third-party services also adhere to cybersecurity standards.

Cybersecurity for banks should be part of the institution's DNA, not a separate component.

Real-World Example: When Cybersecurity Fails

Consider the Capital One breach, where over 100 million customer records were exposed due to a misconfigured firewall. The cybersecurity in banking failure wasn't due to a lack of resources but to an oversight in implementation. It cost the company over $80 million in fines and lost reputation.

This underscores the importance of both strong tools and constant vigilance.

Future Trends in cybersecurity in banking

Looking forward, cybersecurity in banking is heading into more complex territory:

- AI & Machine Learning: For predictive threat detection

- Blockchain: To secure transactions and improve transparency

- Quantum-Resistant Encryption: Preparing for future quantum computing threats

- Behavioral Biometrics: Adding another layer to identity verification

Even amid economic shifts, cybersecurity opportunities are evolving, especially as financial systems face increasing pressure. Cybersecurity in banking sector must stay ahead of the curve to be effective.

Final Thoughts on Cybersecurity in Banking

At the end of the day, cybersecurity in banking is about protecting people, money, and trust. As cyber threats grow more advanced, so must our defenses. Cybersecurity for financial services isn’t optional — it's mission-critical.

Banks and financial institutions must embrace a culture of security, from the C-suite to the frontline. With strong cybersecurity solutions for banks, customers can feel safe, operations can remain stable, and the financial ecosystem can thrive.

So, whether you're a bank executive, a customer, or an IT professional, the question isn't whether cybersecurity in banking matters — it’s how fast you're adapting to keep up.

Thinking About Next-Gen Cybersecurity in Banking?

If you're a CISO or vendor navigating the complex world of cybersecurity for financial services, chances are you know how challenging it can be to find the right match. That’s exactly where Execweb comes in: it’s a smart marketplace built exclusively for CISOs and cybersecurity vendors to discover one another and connect through pre-qualified 1:1 meetings or expert roundtables

So if your bank is looking for innovative cybersecurity solutions or if you’re a vendor aiming to reach the right decision-makers, Execweb helps you build those meaningful, time-saving connections without the noise. It’s expertise-backed, relationship-driven, and tailor-made for securing financial systems at scale.

FAQs:

1. What is cybersecurity in banking?

Cybersecurity in banking refers to the practices and technologies used to protect financial institutions and their customers from cyber threats. This includes safeguarding data, preventing fraud, securing online transactions, and ensuring that digital systems like mobile banking apps and ATMs are not vulnerable to attacks.

2. What are the 5 types of cybersecurity?

The five major types of cybersecurity relevant to banks include:

- Network Security – Protects the integrity of the bank infrastructure and data flow.

- Information Security – Secures sensitive customer and financial data.

- Application Security – Ensures banking apps are safe from code-level threats.

- Cloud Security – Protects data stored and processed in the cloud.

- Operational Security (OpSec) – Covers internal processes, policies, and access controls within banking operations.

3. Do banks have good cybersecurity?

Generally, large banks invest heavily in cybersecurity and follow strict regulations, making them relatively secure. However, evolving threats like phishing, ransomware, and supply chain attacks mean even top banks must constantly update and improve their defenses. Smaller institutions may have weaker systems and are often targeted more frequently.

4. How much do banks spend on cybersecurity?

Banks allocate substantial budgets to cybersecurity. On average, large banks may spend 7% to 10% of their IT budgets on cybersecurity alone. In dollar terms, this can mean tens or even hundreds of millions annually, depending on the size and region of the institution.

Comment